Applying for a mortgage loan can be an overwhelming process, especially if you’re unsure about the documentation required. Lenders require specific information to verify your financial stability, creditworthiness, and ability to repay the loan. Being prepared with the right documents not only speeds up the process but also improves your chances of approval. This guide will outline the essential paperwork you need, tips to gather them efficiently, and how to avoid common mistakes. By the end, you’ll feel more confident in managing this critical step toward homeownership.

Proof of Identity

To apply for a mortgage loan, you’ll need to provide proof of your identity. This typically includes government-issued identification such as a driver’s license, passport, or state ID. Lenders use these documents to verify that you are who you claim to be and to ensure compliance with legal requirements. If you’ve had a name change or use multiple forms of identification, you may need additional supporting documents like a marriage certificate. Make sure your identification is up to date to avoid unnecessary delays. Providing clear, legible copies will help expedite this step.

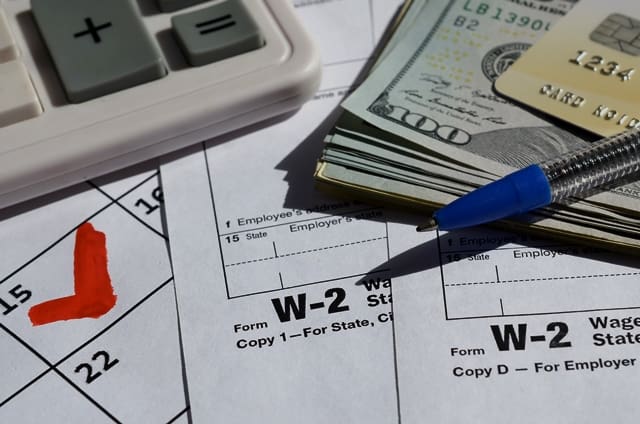

Income Verification

Your lender needs to confirm that you have a stable income to repay the mortgage loan. Commonly required documents include recent pay stubs, W-2 forms, and tax returns from the past two years. If you’re self-employed or have irregular income, you may need additional paperwork such as profit-and-loss statements or 1099 forms. Having consistent and accurate records makes it easier for lenders to assess your financial stability. Keep these documents organized and ensure that all information matches what you’ve provided on your loan application.

Credit and Debt Documentation

Lenders evaluate your creditworthiness using your credit history and existing debt. To support this, you’ll need to provide a credit report, which the lender often obtains with your permission. You might also need to share details of other loans, credit card statements, or outstanding balances. Be prepared to explain any discrepancies or derogatory marks, such as late payments or collections. Reducing your debt-to-income ratio before applying can improve your chances of approval. Accurate and honest reporting of your financial obligations is key to a smooth application process.

Asset Verification

Documentation of your assets is crucial in showing that you have sufficient funds for a down payment, closing costs, and financial reserves. Bank statements for the past two to three months are typically required, along with investment account statements, retirement funds, or proof of other significant assets. If you’ve received large deposits recently, you’ll need to provide an explanation, such as a gift letter if the funds were gifted. Lenders look for consistency and transparency in your financial records to ensure there’s no risk of fraudulent activity. Preparing these documents in advance reduces the risk of last-minute issues.

Conclusion

Understanding the documentation needed for a mortgage loan can save you time and reduce stress. Key requirements include proof of identity, income verification, credit and debt records, and asset documentation. Ensuring these documents are accurate and organized will help streamline the process and increase your chances of approval. Taking proactive steps to prepare and clarify any discrepancies demonstrates your financial responsibility to lenders. With the right preparation, you’ll be one step closer to securing your dream home.

#MortgageLoan #HomeBuyingTips #LoanDocumentation #RealEstate #Homeownership #FinancialPlanning #CreditReport #AssetVerification

For a copy of our home buying process, please fill out the form on this page. The guide will be emailed immediately.

If you are looking for assistance in the metro Atlanta area, please reach out to us. We would love the opportunity to help you with your home purchase or sale.

If you are in another part of the country, we may be able to refer you to an agent in your market.